The smart Trick of Summitpath Llp That Nobody is Talking About

The smart Trick of Summitpath Llp That Nobody is Talking About

Blog Article

4 Easy Facts About Summitpath Llp Shown

Table of ContentsThe Buzz on Summitpath LlpThings about Summitpath LlpSome Known Details About Summitpath Llp The Summitpath Llp DiariesNot known Details About Summitpath Llp

A monitoring accountant is a vital function within an organization, however what is the role and what are they anticipated to do in it? Working in the accountancy or money department, monitoring accountants are accountable for the prep work of management accounts and a number of various other reports whilst likewise overseeing general accountancy procedures and methods within the organization - tax preparation services.Compiling techniques that will certainly lower company expenses. Getting money for projects. Recommending on the monetary effects of business decisions. Establishing and managing economic systems and treatments and recognizing opportunities to improve these. Controlling earnings and expenditure within business and guaranteeing that expenditure is inline with budget plans. Managing audit technicians and support with common book-keeping jobs.

Evaluating and taking care of danger within the service. Administration accountants play a highly vital duty within an organisation. Secret monetary data and records generated by administration accountants are used by elderly administration to make educated business choices. The evaluation of company performance is a vital function in a management accountant's work, this analysis is produced by considering existing monetary details and likewise non - financial information to figure out the position of the organization.

Any kind of business organisation with a monetary division will call for a management accounting professional, they are additionally frequently used by banks. With experience, a monitoring accountant can anticipate strong profession development. Specialists with the required certifications and experience can take place to become monetary controllers, financing supervisors or primary financial policemans.

The Definitive Guide for Summitpath Llp

Can see, assess and recommend on alternating sources of business finance and various means of elevating financing. Communicates and recommends what impact economic choice making is having on developments in law, values and administration. Assesses and recommends on the best strategies to take care of service and organisational performance in regard to business and money danger while interacting the impact properly.

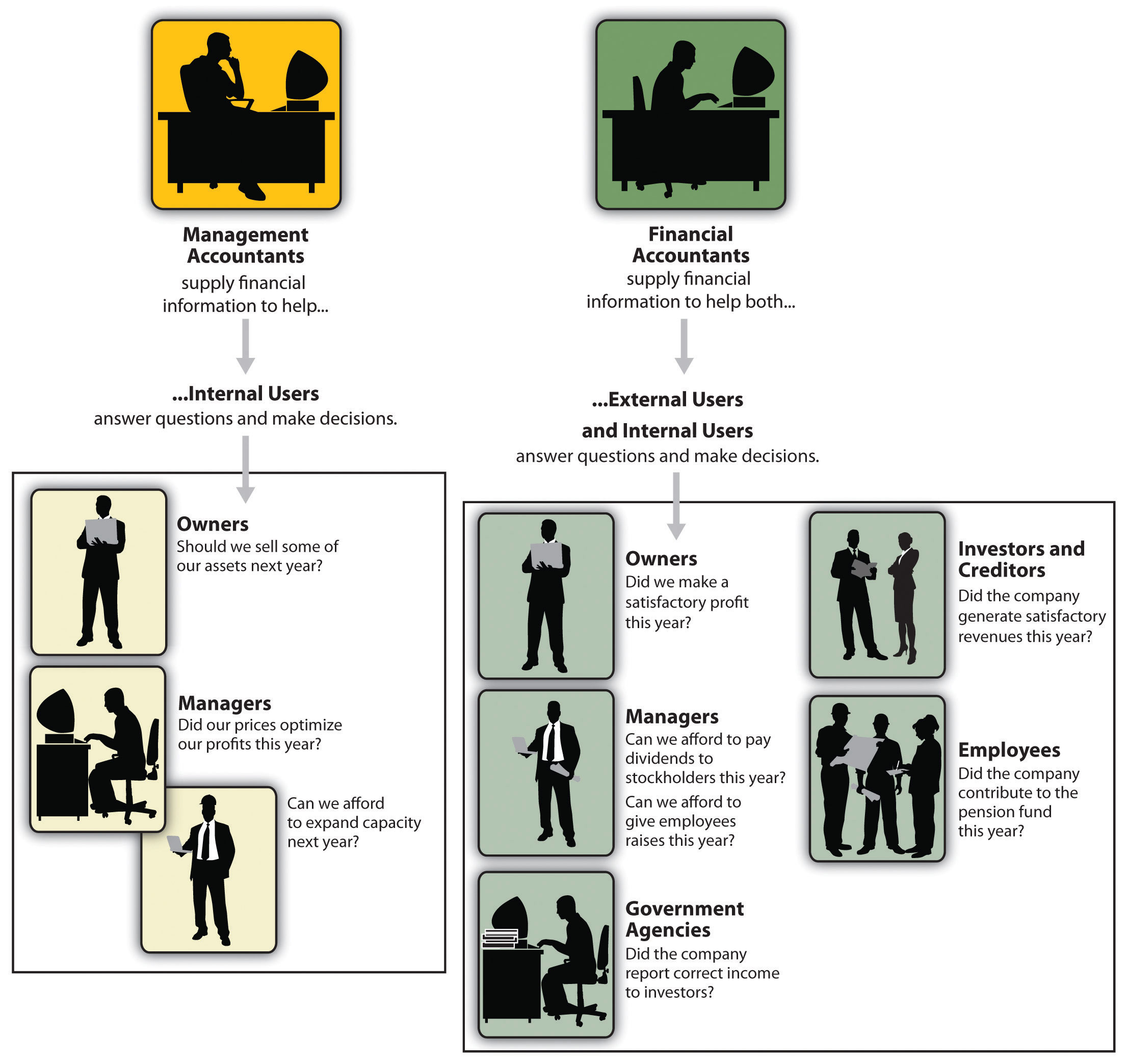

Utilizes various ingenious approaches to execute approach and manage modification - CPA for small business. The difference between both monetary audit and managerial bookkeeping concerns the designated individuals of details. Supervisory accountants require service acumen and their purpose is to act as company partners, assisting magnate to make better-informed decisions, while economic accountants aim to create monetary files to provide to outside celebrations

9 Simple Techniques For Summitpath Llp

An understanding of company is also essential for management accounting professionals, in addition to the capability to interact efficiently in any way levels to advise and communicate with senior members of team. The obligations of a monitoring accountant should be executed with a high level of organisational and critical thinking abilities. The typical salary for a legal administration accountant in the UK is 51,229, a rise from a 40,000 typical earned by monitoring accountants without a chartership.

Providing mentorship and management to junior accounting professionals, fostering a society of partnership, development, and operational quality. Working together with cross-functional teams to create budgets, projections, and long-lasting economic approaches. Staying educated regarding adjustments in bookkeeping regulations and ideal practices, using updates to internal procedures and paperwork. Essential: Bachelor's degree in accountancy, financing, or an associated field (master's preferred). Certified public accountant or CMA certification.

Charitable paid pause (PTO) and company-observed holidays. Expert advancement possibilities, including compensation for certified public accountant qualification costs. Flexible work alternatives, consisting of crossbreed and remote schedules. Access to wellness programs and worker aid sources. To apply, please submit your resume and a cover browse around this web-site letter outlining your certifications and passion in the elderly accounting professional duty. Calgary Accountant.

The Ultimate Guide To Summitpath Llp

We aspire to discover a knowledgeable senior accountant ready to contribute to our business's monetary success. For inquiries concerning this placement or the application procedure, contact [HR contact info] This task publishing will end on [date] Craft each section of your task description to reflect your organization's distinct requirements, whether employing a senior accountant, corporate accountant, or another specialist.

A strong accounting professional task account surpasses detailing dutiesit clearly communicates the credentials and expectations that align with your company's needs. Distinguish in between crucial certifications and nice-to-have abilities to assist prospects determine their viability for the placement. Define any kind of qualifications that are obligatory, such as a CPA (Cpa) license or CMA (Qualified Monitoring Accounting professional) classification.

5 Easy Facts About Summitpath Llp Shown

"prepare monthly monetary declarations and oversee tax obligation filings" is much clearer than "handle economic documents."Mention crucial locations, such as financial reporting, bookkeeping, or pay-roll management, to draw in prospects whose abilities match your needs.

Use this accounting professional work description to develop a job-winning return to. Accounting professionals aid organizations make vital economic choices and corrections. They do this in a range of methods, consisting of study, audits, and information input, reporting, evaluation, and tracking. Accountants can be responsible for tax reporting and filing, resolving equilibrium sheets, aiding with department and business budgets, financial forecasting, communicating findings with stakeholders, and more.

Report this page